Last year Amazon launched two high-profile AmazonBasics products - a $59.99 Alexa-enabled microwave and a foam mattress starting at $129.99. However, while the microwave became the best-seller from day one, the mattress failed to do the same.

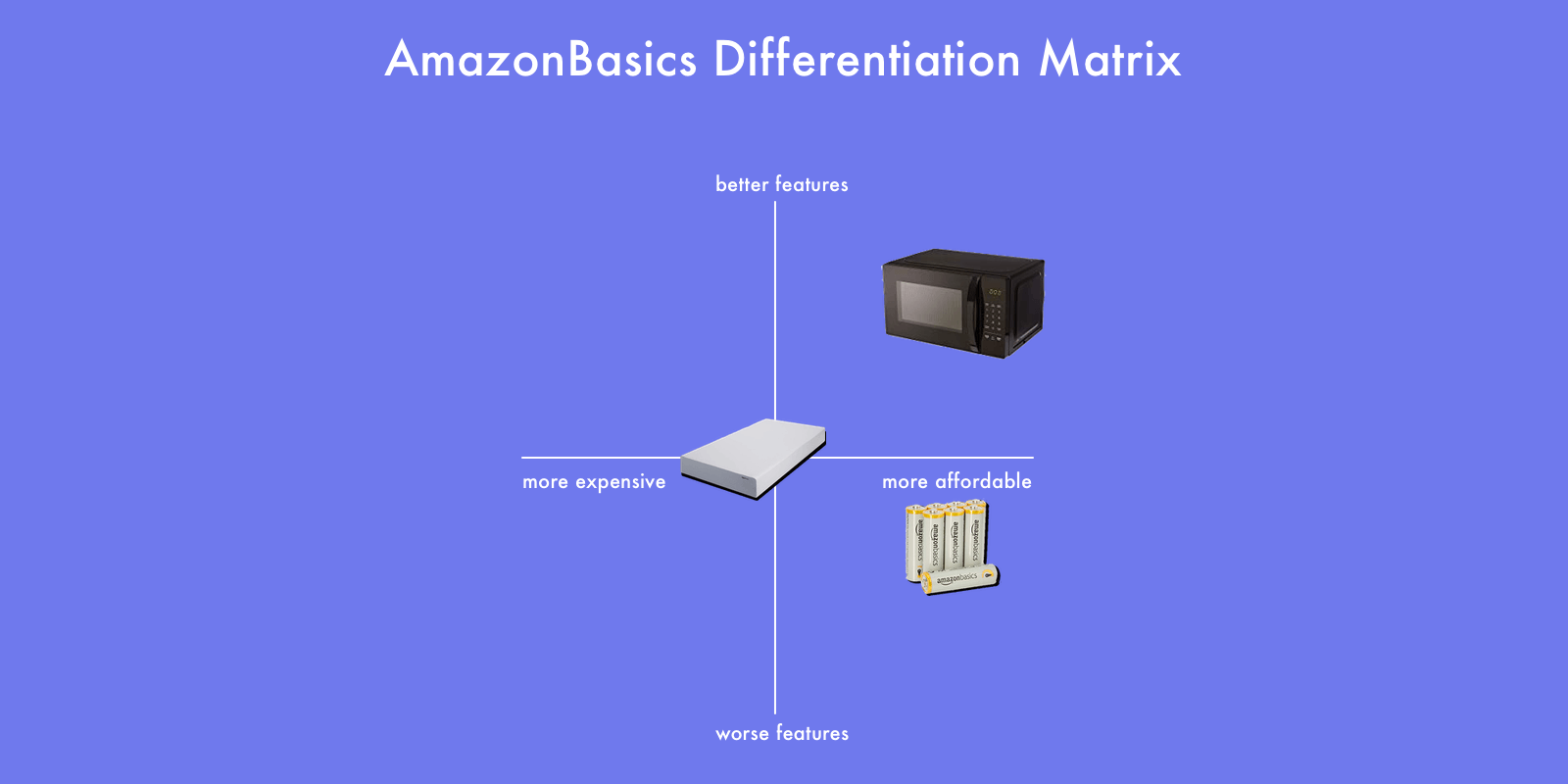

The success, or the lack thereof, has little to do with the company’s well-documented prioritization of its brands in search results (they show up in search results in a separate box titled “Top Rated from Our Brands”). Nor the ability to use data collected from the platform to launch products. Instead, it is the price and differentiation that determined the success of those two products.

AmazonBasics microwave is more affordable than microwaves by established brands like Toshiba and Panasonic, and it has a feature they don’t - Alexa voice assistant support. While Alexa support is not a ground-breaking difference, it does differentiate the AmazonBasics product from the competition. Ultimately it is the low price that is key.

The mattress, on the other hand, has neither of those advantages. Feature-wise it is practically identical to other mattresses in the category, and it is not more affordable than the competition. Best selling mattresses in the category have more reviews, a better star rating, and are more affordable. 8-inch twin mattress by AmazonBasics is available for $129.99, while the best-seller Linenspa mattress is only $97.96. It also has more than 10,000 reviews, compared to 500 for the AmazonBasics mattress.

Looking at AmazonBasics batteries - the most successful product under the brand - through the same analysis, puts them at a bit worse than the competition in terms of battery performance, but considerably more affordable. Despite Energizer’s and Duracell’s marketing, most shoppers are happy to go for a more affordable option. AmazonBasics batteries are 30% cheaper than Energizer, but only slightly worse in performance.

The number of AmazonBasics best-sellers has grown by fifty percent in a year. However, the success of an AmazonBasics product largely depends on the conditions of the category. AmazonBasics focuses on commodities, in categories which: products themselves are commodities, and no brand “owns” the category as a result of fragmentation and downward price pressure.

“I was at Amazon when one of the first AmazonBasic products was conceptualized. It was a stereo cable, and the logic was that customers were paying far too much for products that were not objectively worth the price premium and that in the inordinate margin leading manufacturers were reaping based on their ability to create a perception of value was an opportunity.”

– Tod Harrick, VP Product, Marketplace Ignition

Thus it is not true that the company can make every product it launches a success thanks to the clear advantage in visibility in search results. It depends on the competition.

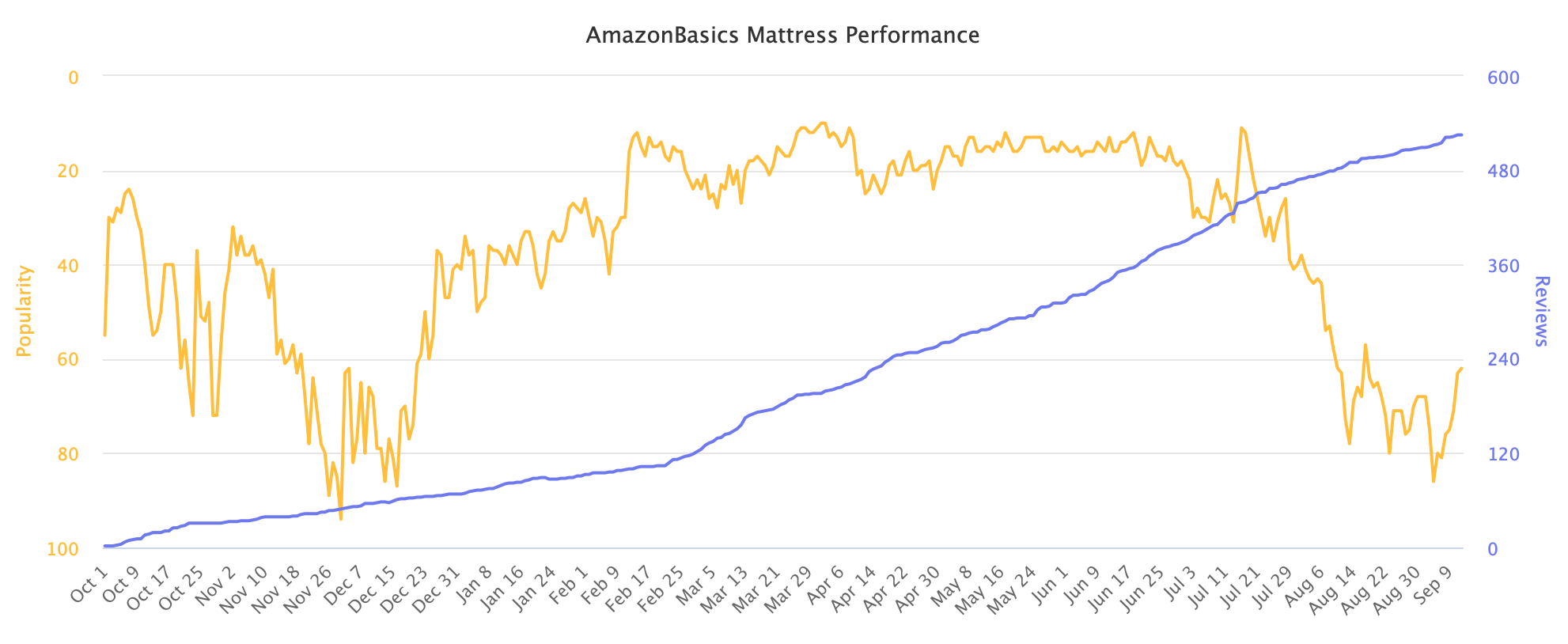

In this case, the mattresses competition meant that despite Amazon’s advantages, their mattress is not a success. At least not in the sense of becoming the best-seller in the category. It was not able to offer a more affordable product, and differentiating on features is not AmazonBasics strength either. Since launch, AmazonBasics mattress best position in the category was in the top 20. However, over the past few months, it has fallen down the ranks and is now outside of the top 50. The Linenspa mattress mentioned above has remained the best-seller throughout the time, doubling the number of positive reviews in a year. Also, so has the rest of the top 10 remained virtually unchanged.

Amazon’s private label efforts is not a best-seller-generating magic box. Understanding why some products don’t become best-sellers tells a more revealing story than those who do. That is not to defend their unfair use of platform data and search prioritization, and even more aggressive pushes to its own brands before shoppers click “buy.” Despite all of those, it takes more to become a best-seller on Amazon; even if it is Amazon itself doing it.