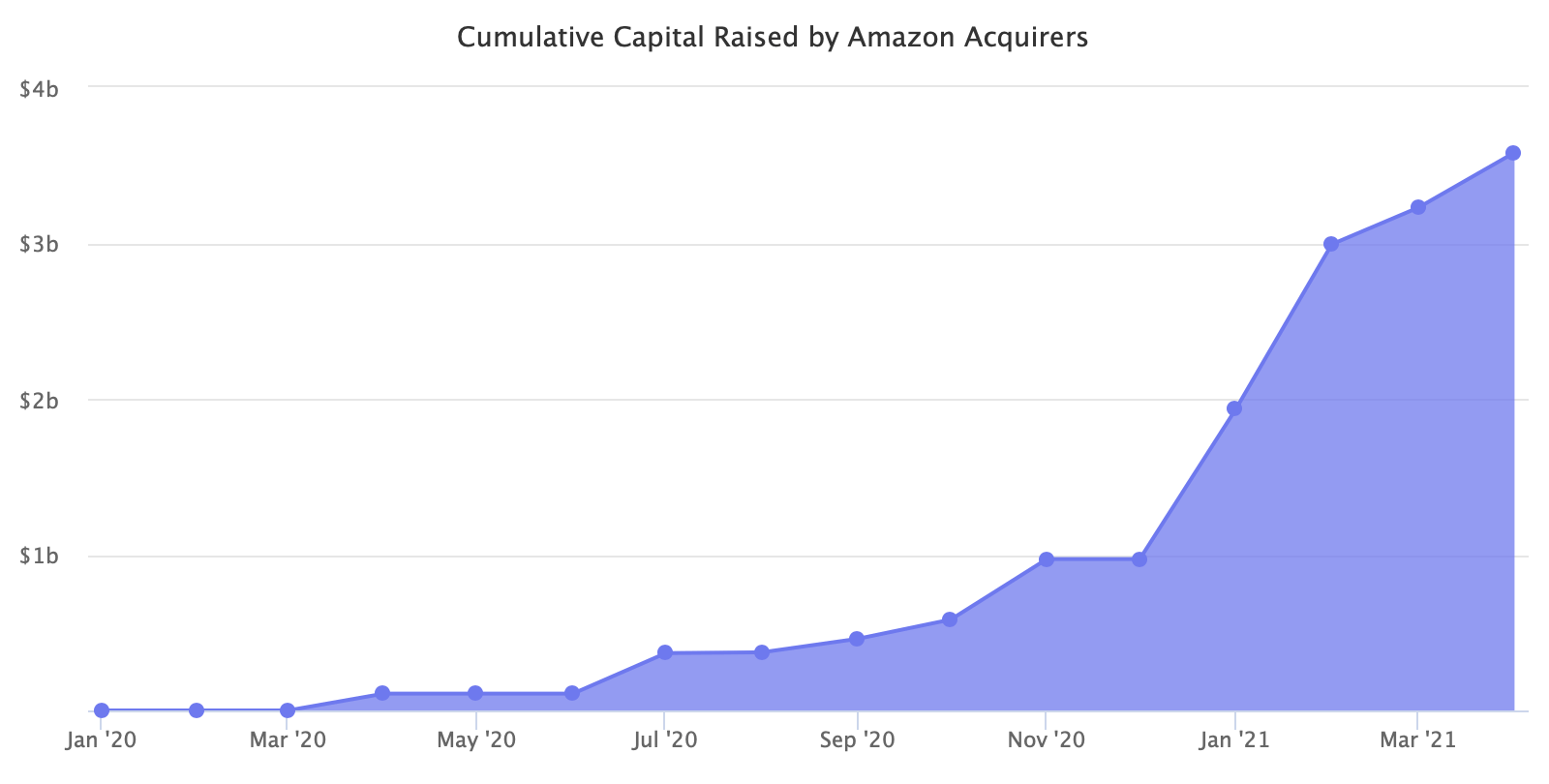

Firms acquiring successful brands on Amazon have attracted over $3.5 billion in capital over the past twelve months. $2.5 billion of that was raised in just the first four months of 2021.

Capital committed is a mix of equity and debt. Some firms haven’t yet disclosed their funding, so the total capital raised is even greater. There are also hundreds of established sellers, private equity firms, family offices, and individual investors making acquisitions in this space; thus, the market’s total buying power spans beyond the aggregators.

- April 2021. Berlin Brands Group raises $240 million

- April 2021. Elevate Brands raises $12.5 million

- April 2021. Thrasio raises $100 million

- March 2021. Benitago Group raises $55 million

- March 2021. SellerX raises $31 million

- March 2021. The Stryze Group raises $100 million

- March 2021. Boosted Commerce raises $50 million

- February 2021. Elevate Brands raises $55 million

- February 2021. Technology Commerce Management (TCM) raises $28 million

- February 2021. Unybrands raises $25 million

- February 2021. Valoreo raises $50 million

- February 2021. Branded raises $150 million

- February 2021. Thrasio raises $750 million

- January 2021. Berlin Brands Group commits $300 million

- January 2021. Razor Group raises $12 million

- January 2021. Cap Hill Brands raises $150 million

- January 2021. Thrasio raises $500 million

- November 2020. SellerX raises $118 million

- November 2020. Heyday raises $175 million

- November 2020. Razor Group raises $30 million

- November 2020. Heroes raises $65 million

- October 2020. Perch raises $123.5 million

- September 2020. Boosted Commerce raises $87 million

- August 2020. Razor Group raises $5 million

- July 2020. Thrasio raises $260 million

- April 2020. Thrasio raises $100 million

- April 2020. Perch raises $8 million

There are more than fifty active Amazon seller aggregators. Thrasio, Heyday, Perch, Boosted Commerce, and Cap Hill Brands are the largest in the U.S. There are also firms in the U.K., Germany, France, Spain, Israel, Singapore, Mexico, Ireland, Belgium, Finland, and Canada.

While attracting the most attention, the capital raised and the profit multiples paid for acquisitions are not the key topics. On the surface, those firms look like typical private equity roll-ups; however, they are much more e-commerce operators. They are not investors; they are supply chain, Amazon, marketing, sourcing, branding, and other experts.

When the original aggregators started, they were acquiring sellers at low multiples and valuing them as commodities, often sourcing deals from browsing public directories of sellers for sale. The capital of an aggregator was buying assets that were generating revenues, but little attention was paid to what those assets looked like. That attracted other firms to raise capital and start doing the same because the business looked obvious.

That market went away. The industry grew in sophistication quickly because more capital increased competition among buyers and because sellers learned to navigate it often thanks to brokers. Rising profit multiples are the numeric representation of the market evolving.

The ability to operate and scale the Amazon brands acquired and take them outside of Amazon is how the aggregators differentiate. It is relatively easy to spend the capital raised compared to running hundreds of Amazon seller accounts. For many firms that entered the market without previous experience on Amazon, the marketplace’s nuances will be the biggest hurdle. There have already been over a dozen firms that launched but disappeared months later.

Meanwhile, capital flowing into aggregators is attracting broader attention that wants to invest in the Amazon marketplace. While aggregators are looking to buy private label sellers, there is newfound interest from large private equity firms to invest in other types of sellers like resellers. Simultaneously, some of the aggregators have also started to make their acquisitions in China, perhaps the largest pool of sellers.

Many of the Amazon aggregators are eyeing to build Amazon-native CPG conglomerates similar to Unilever or Procter & Gamble. That’s the long-term goal. In the meantime, the industry is a well-capitalized experiment trying to find what will get them there.