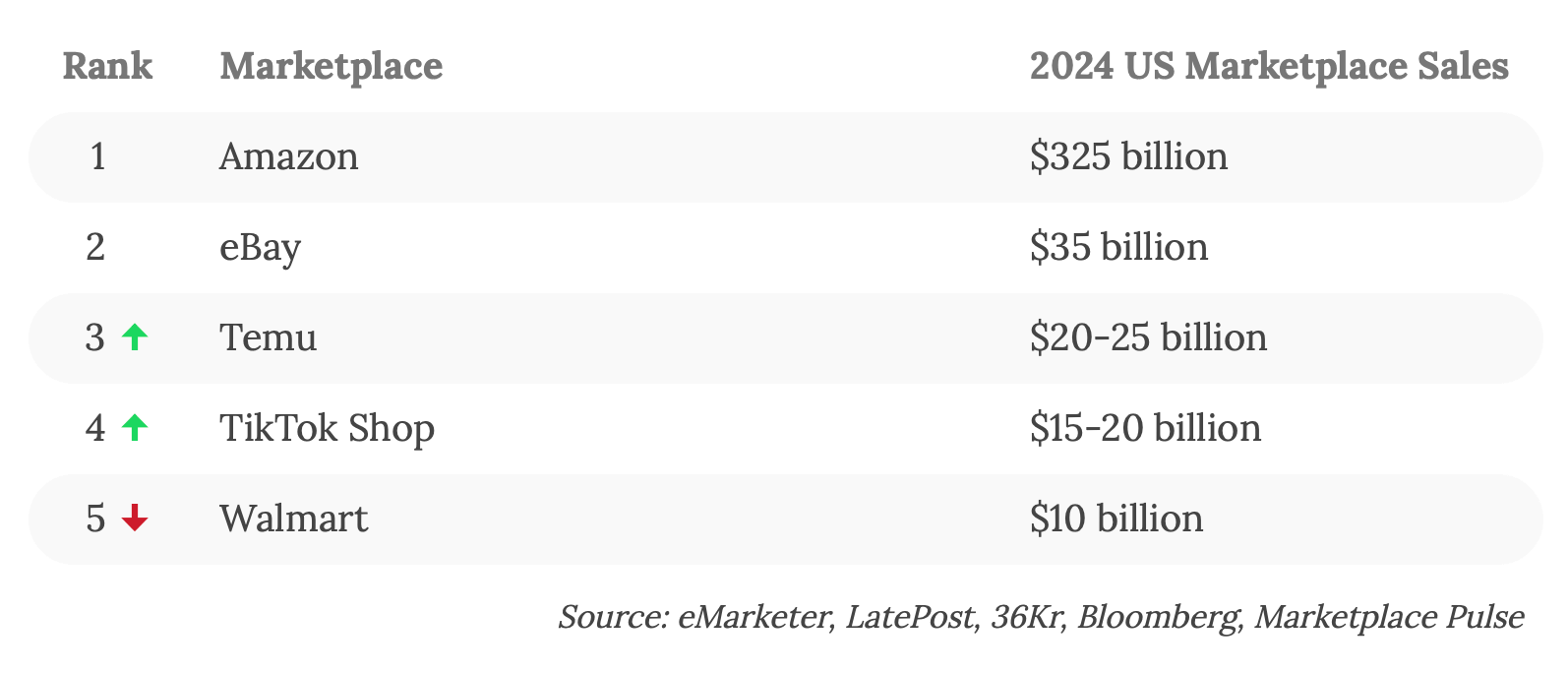

Amazon, Walmart, and TikTok Shop are the three top marketplaces for U.S. brands. However, if Temu and TikTok achieve their goals this year, they will overtake Walmart in the marketplace ranking.

Amazon is the largest marketplace in the U.S., selling three times more than the rest combined. According to eMarketer and Marketplace Pulse projections, it will achieve $325 billion in sales this year. That’s sales by third-party sellers only and doesn’t include sales by Amazon as a retailer. With the first-party sales included, Amazon is likely the biggest online and offline retailer in the U.S.

eBay will do $35 billion in sales this year. That’s nearly the same as its U.S. GMV in 2022 and 2023 since eBay has not shown growth in years. It remains a significant player in the market but is now focused on what it calls “enthusiasts” and thus is not a key channel for most brands outside of outlet sales. “When you’re talking to business-to-consumer sellers who are primarily selling ‘new and in-season,’ they’re going to be more likely to sell on Amazon or Walmart,” said Jamie Iannone, CEO of eBay, in 2022. “eBay was trying to move into that space. I don’t think it’s a long-term place where we can win,” he added.

Walmart is a $10 billion marketplace, according to estimates. Walmart will make north of $100 billion in e-commerce sales in the U.S. this year after surpassing that number globally in 2023, but most of that will be its retail sales, often fulfilled from stores. eMarketer reports that Walmart’s third-party sales will reach $10.37 billion this year. Compared to Amazon, where the marketplace represents more than 60% of total GMV, it is at best 10% on Walmart. But, like on Amazon, the marketplace is growing faster than first-party sales on Walmart.

Temu has set a $60 billion sales goal for this year. The U.S. will account for 40% of that. While initially only selling in the U.S. when it launched in September 2022, it now likely gets more sales volume in Europe. Some might dismiss it as a marketplace because it acts like a retailer — Temu, rather than its sellers, controls selection and pricing for most of the assortment. It is quickly growing past that with sellers with local warehouses, but all of them are still based in China.

TikTok aims to grow the size of its TikTok Shop U.S. e-commerce business to as much as $17.5 billion this year, its first full year, as Bloomberg has reported. That’s all from its willingness to aggressively promote shopping content and live streams. However, additional reporting by 36Kr said that TikTok eyes $12-$13 billion for the second half of this year, suggesting that it might be underperforming the $17.5 billion goal. Yet anecdotal reporting from sellers suggests that TikTok Shop has already exceeded Walmart for some. TikTok “remains optimistic about its prospects in the U.S. market despite facing a political headwind,” heard in a small closed-door meeting in Shenzhen in mid-May.

Outside of offline retail and direct-to-consumer (DTC), there are only five channels — all marketplaces — at or above $10 billion. Amazon is the largest, Walmart is the obvious second step, and TikTok is quickly becoming the dominant social commerce channel. eBay is back to focusing on its original mission of resale, and Temu is exclusively for Chinese sellers; neither is a promising channel for U.S. brands. Everything else is too small (like Target) or too niche (like Etsy) except specialty marketplaces fitting the brand that could outperform others.