The e-commerce industry is bracing for impact as U.S.-China trade tensions intensify. Following the introduction and rapid escalation of reciprocal tariffs on Chinese goods by the Trump administration, the expected impact on tariff income, shipment volumes, and price trends has not yet taken hold, but will soon.

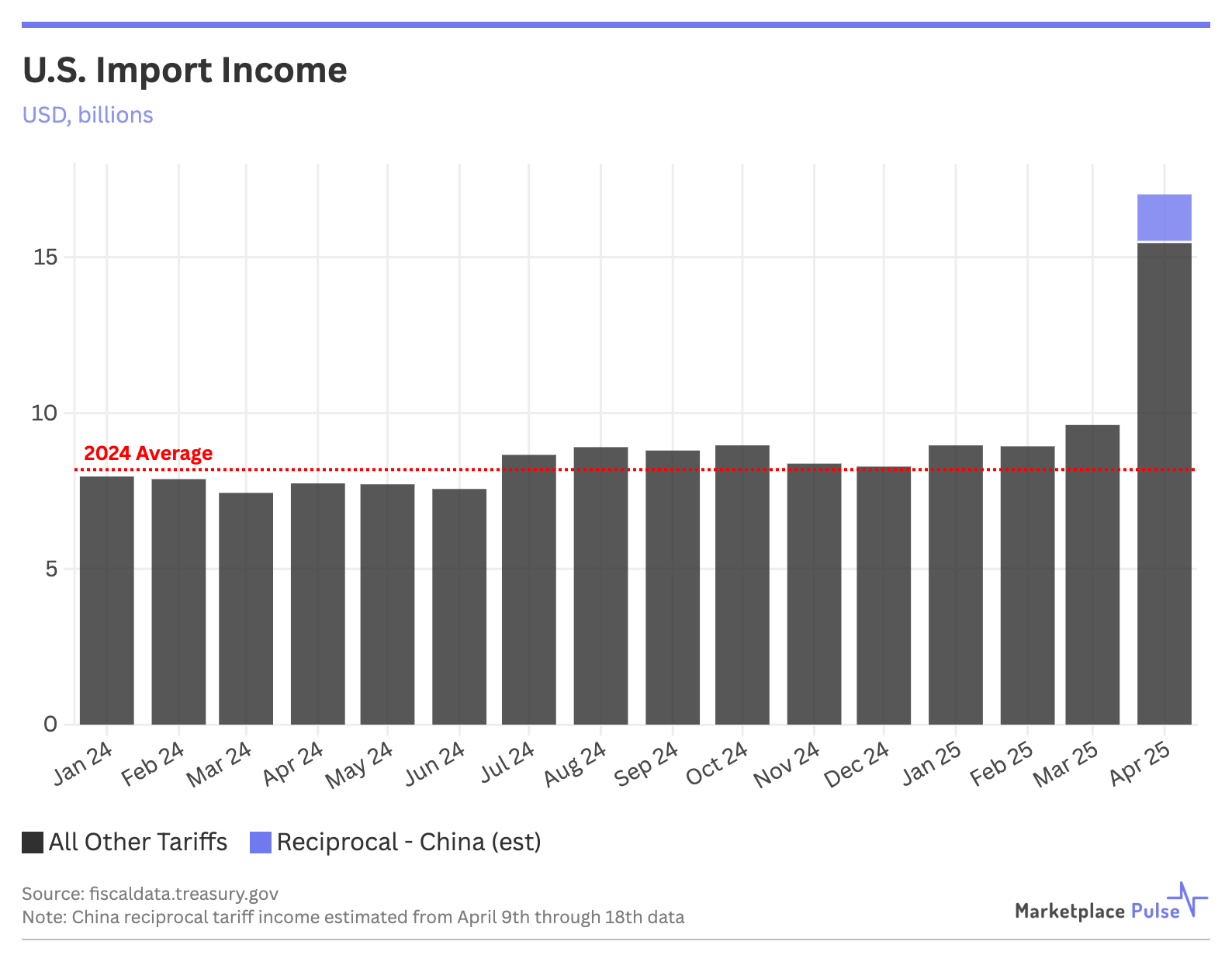

U.S. tariff income did hit record levels in April, surging to over $17 billion from a 2024 average of $8 billion per month. However, CBP data reveals that this spike stems largely from non-China tariffs, suggesting the real China-specific impact remains to be seen.

Import volumes at the Port of Los Angeles have dropped 30% week-over-week and 10% year-over-year, but forecasts predict a rebound within two weeks.

Meanwhile, data from Amazon pricing analysis tool CamelCamelCamel shows no widespread price increases on Amazon yet. This is the calm before the inevitable storm.

“A full-blown supply chain disaster is looming,” warns Steven Borrelli, founder of Cuts Clothing. Aaron Rubin of ShipHero, whose software processes 1% of U.S. e-commerce, takes a more definitive stance: “It’s not just looming, it’s inevitable at this point.”

The global pause in March 2020, during the onset of COVID-19, triggered two years of industry disruption, including nine months of container rates exceeding $10,000, and a further year before rates returned to relative normalcy. This current impasse bears uncomfortable similarities.

The first merchants to make decisive supply chain pivots could gain significant advantages, but a rapid decoupling from reliance on Chinese manufacturing presents challenges in every direction.

Reciprocal tariffs on other potential manufacturing hubs have been paused, and new tariff levels won’t be confirmed until, most likely, July. Investing in relocating supply chains to locations with unknown future logistics costs is futile.

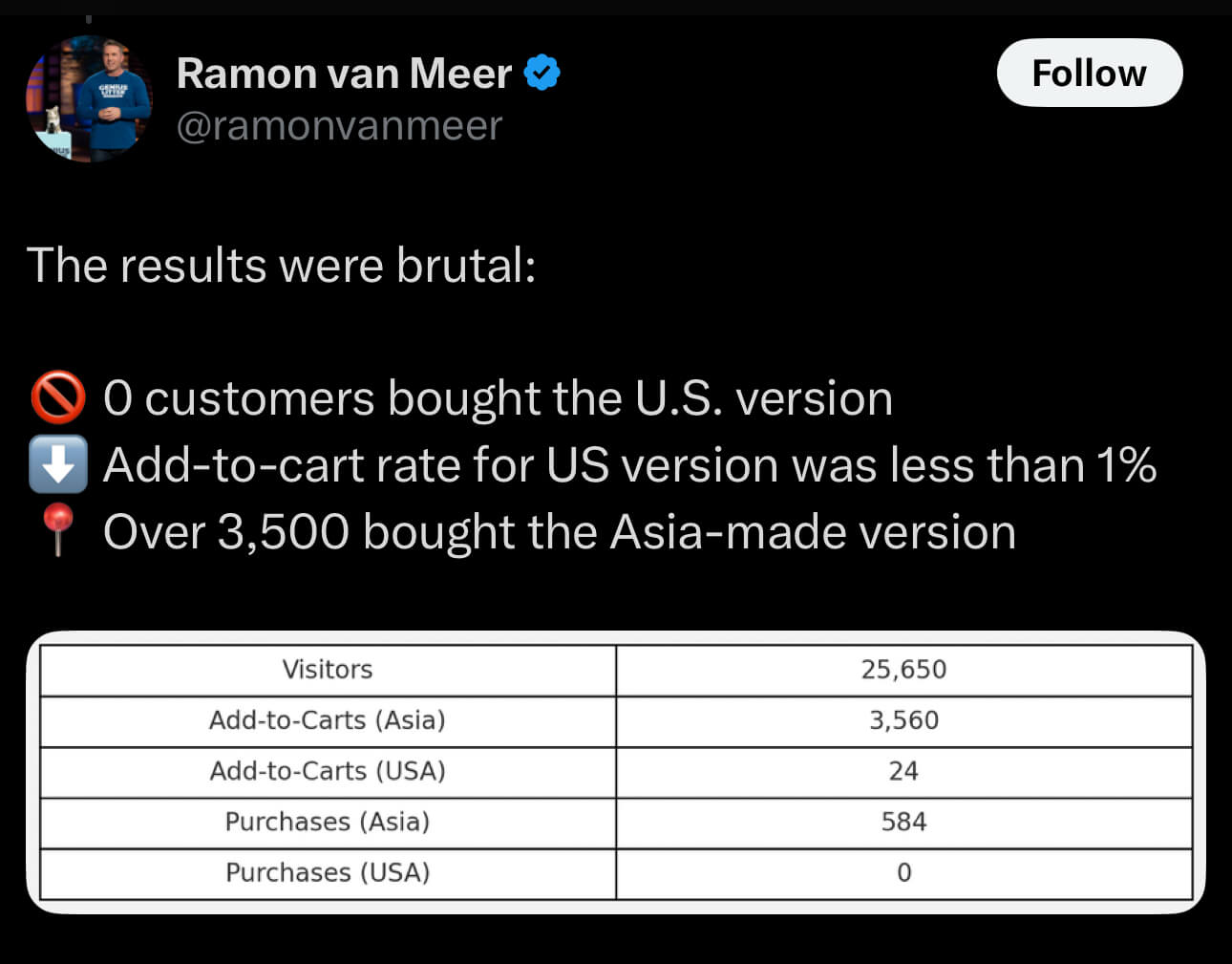

Alternatively, repatriating manufacturing to the U.S. is the American dream, but when the bathroom brand Afina ran an A/B test of a made-in-America showerhead priced at $239 versus an Asia-made version for $129, the cheaper Asia-made product generated 584 purchases, while the more expensive American-made product generated zero. In e-commerce, the reality of price sensitivity outweighs the notion of nationalism.

Walmart and Target executives have privately warned President Trump that the current tariff policy will lead to empty shelves in the coming weeks. Without swift resolution, it won’t just be the coming weeks in danger, but—much like the COVID pandemic disruption—the effects will ripple for years to come.