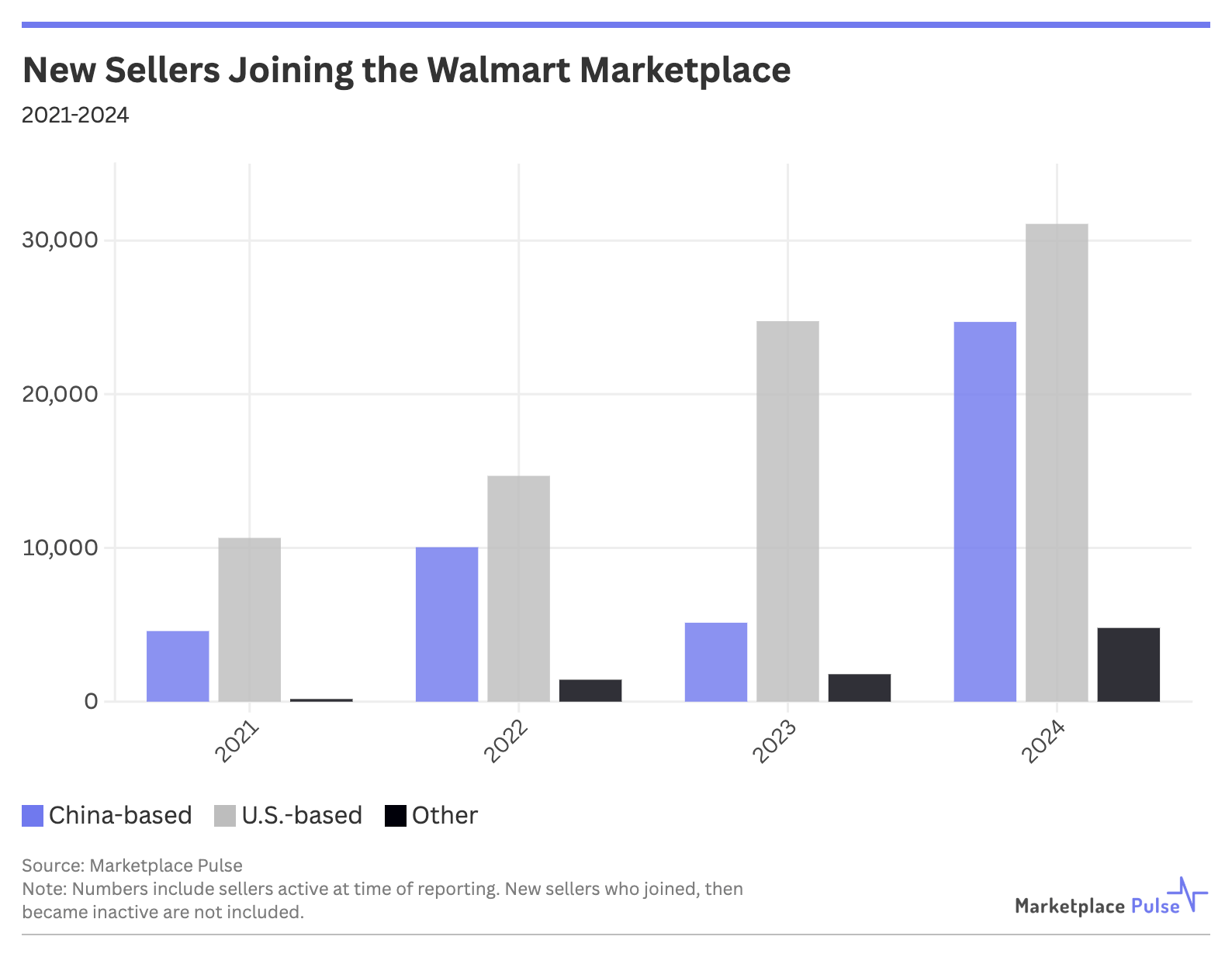

In 2024, Chinese sellers made up nearly half of the new sellers added to Walmart’s marketplace, accelerating the platform’s transformation into yet another channel dominated by Chinese merchants. Walmart’s marketplace is following Amazon’s path – where Chinese sellers already represent more than 50% of sellers.

According to Marketplace Pulse data, 41% of new sellers joining Walmart in 2024 were based in China, up from just 16% of new additions in 2023. March and April saw particularly pronounced growth when two-thirds of new sellers were China-based.

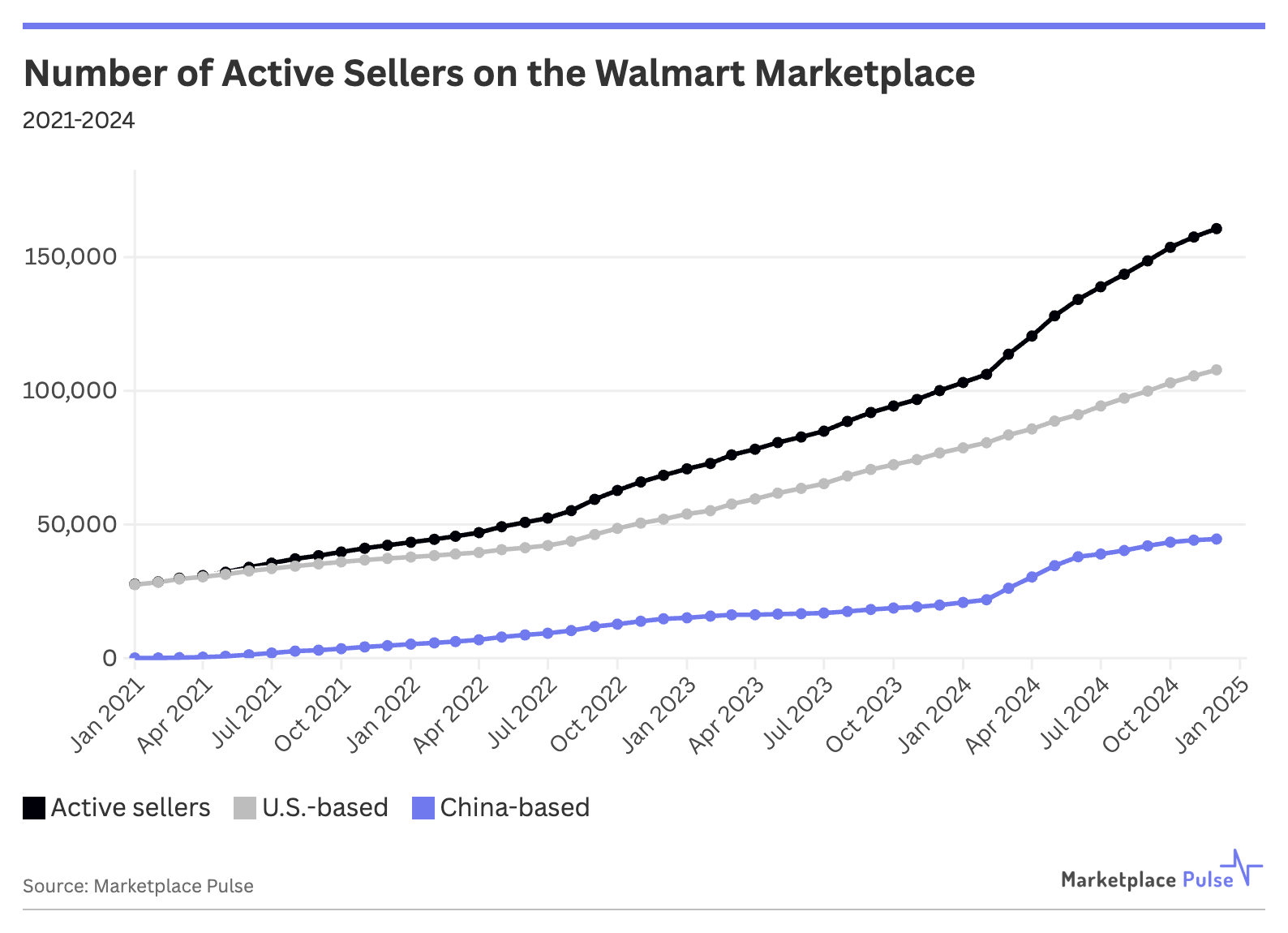

As a result, Chinese sellers now represent 28% of all active sellers on Walmart, up from 20% at the end of 2023 and less than 1% at the start of 2021.

The rapid rise of China-based sellers on Walmart mirrors that of its main competitor, Amazon. The speed of the transformation is particularly concerning for U.S.-based sellers because it suggests the structural advantages Chinese sellers enjoy are becoming more impactful, even as some of these advantages begin to face increased scrutiny.

“I’m not advocating for an unfair advantage,” former Amazon employee turned seller Shinghi Detlefsen recently told Fortune. “I’m just advocating for a level playing field.” Detlefsen points to a complex web of advantages enjoyed by Chinese sellers, from tax benefits to regulatory arbitrage.

One such advantage – the de minimis trade rule that allowed duty-free shipments under $800 – was recently suspended by the Trump administration before being temporarily reinstated due to logistical challenges. This rule helped low-cost Chinese platforms build multi-billion-dollar businesses by avoiding tariffs U.S. sellers had to pay.

The challenges extend beyond just taxes, though. According to Fortune’s reporting, it’s commonly believed in seller circles that many China-based merchants find ways to avoid proper liability insurance requirements – a high cost for high-volume merchants that U.S. sellers must bear.

Some have also developed reputations for aggressive competitive tactics, including posting fake negative reviews on rival products.

Billionaire entrepreneur Mark Cuban has shared his concerns, proposing that Chinese merchants should have to register products on a government website for 90 days before selling online, allowing for intellectual property review to help fight the rise of counterfeit goods.

While still a fraction of Amazon’s millions of sellers – and, as a result, less likely to attract such high-stakes tactics – Walmart’s growth rate is accelerating – up 60% in 2024 to over 160,000 sellers, fueled by aggressive seller recruitment strategies and reduced barriers to entry.

The eventual suspension of de minimis shipments may help level aspects of the playing field. However, Walmart’s trajectory suggests it is following Amazon’s path – where Chinese sellers now dominate the platform – and without broader policy changes, that seems unlikely to change.